Expert advice you won’t find anywhere else!

Watch these videos

We promise much better results

Free expert advice for every marketing professional: The list you order is never the list you receive. Sales, income, employees, ages, and even home ownership are nearly all simply estimated (modeled) data. Selecting the most accurate list source and understanding these models will help you minimize the disaster lurking within every list purchase.

Selecting the most accurate list source and understanding these models will help you minimize the disaster lurking within every list purchase.

1. Do not buy from a website.

99% sell out-of-date, “wholesale” data. Only a contract with D&B, Hoovers, Epsilon, InfoUSA, etc., allows you to access current-month data and all available selects. If you do choose to buy directly from a website you should also be intimately familiar with all of the available selects and how they impact your purchase.

2. Do not buy from a reseller unless they can prove they are providing current-month data.

99% of list brokers, ad agencies, mail shops, printers, etc. (even the largest and best-known), sell out-of-date wholesale data.

Even if their sales pitch mentions Dun & Bradstreet, Epsilon, Equifax, Experian, Acxiom, etc, it is not the compilers’ current-month “Retail” data. It is almost always simply “updated” 4 to 8-month out-of-date wholesale data. In addition, many are not familiar with the available and most appropriate selects.

3. The USPS reported 25% of direct mail is “undeliverable as addressed”.

Be certain of all deliverability selects. Even retail lists contain a lot of bad data that can be easily eliminated. DO NOT leave it up to your mail house. Ask for the DPV (Delivery Point Validation) report, which shows the number of USPS recognized addresses, BEFORE they mail it. Even current-month file addresses fail at rates up to 38%. As an example, Dun & Bradstreet offers a DPV select but their reps don’t use it unless you specifically request it.

4. Understand the “selects” you choose. Nearly all selects such as age, income, sales, employees, homeownership, and others are inaccurate “models” that vary tremendously from source to source.

Why does one source offer ten-times more records than a competitor using identical selects? It is because some only offer gathered data (factual and verifiable), where others model, and still others over-model many data elements.

The compilers often obtain less than 20% of a given data element/select from verified sources where 80+% is then “inferred” using (often questionable) models creating unbelievable (and obviously inaccurate) skews. Selects are already extraordinarily inaccurate and models and skews compound the inaccuracies.

5. Get FREE match reports of your purchased or in-house lists to other lists. Simply sending your data to various list compilers as a “suppression” file and asking for counts reveals both delivery problems (saving you $$), and whether “that source” says you are reaching your desired audience. ALL COMPILERS OFFER THIS AT NO CHARGE.

Are we really experts? We believe so. We’ve sold thousands and thousands of lists to the nation’s largest and most sophisticated mailers and (with their help) have learned to cull only the most accurate and appropriate records from nearly any data source. In many other instances we’ve forgone the sale if we found the data untrustworthy. We verify the source of every select, the coverage, skews, and trust very little modeled-data.

We’ve provided 33% of the nation’s 100 largest banks, insurers, and other Fortune 500’s with current-month, “retail” data purchased directly from a compiler rep , saving one top 5-bank over $2,500,000.00 and providing over 500-lists to another top 5-bank. We also provide data to major list compilers and many of the largest list resellers.

Why wouldn’t everybody sell current-month data?

It is because they pay $40 per 1,000 for out-of-date, wholesale business data that retails for $280 per 1,000, plus tax. They sell it at $120 to $150 per 1,000, which is the same price we charge for current-month, retail data.

They pay $10 per 1,000 for out-of-date, wholesale consumer data, which retails at $40 per 1,000, plus tax. They sell it at $20 to $40 per 1,000, which is the same price we charge for current-month, retail data.

Unless your source can prove they are obtaining your data directly from the compilers’ current-month files, we strongly suggest you obtain your data directly from the compiler. We recommend Dun & Bradstreet, or in certain cases InfoUSA for business data and Epsilon for traditional consumer data, or let us obtain it for you.

It takes only a moment to email Sales@DRALists.com or to call 1 (800) 353-5475 for counts and quotes on current month, approriately selected data.

Why not send identical list count requests to 5 or 10 sources?

It takes only minutes and will likely reveal huge discrepancies and insight into your best options and we’ll help you evaluate them without cost or obligation. And, we’ll provide counts from various files for you.

For details on the above and to learn more, please read on. Or, instead let us obtain your current-month data for you using our high volume-low price contracts.

All of your non-standard requests are reviewed by a 30+-year list industry veteran cited on the cover of an industry-leading publication as a, “Super expert,“ and, “The person who knows more about compiled data than anyone we have ever known,” as well as, “Someone you should know!“

Even if you buy directly from the compiler we’ll analyze your counts, selects, lists, campaigns, etc. at no charge and without obligation. You can learn a great deal with a single call or email at no cost.

As an example, we’ll likely remind you the largest compiler:

1. Won’t select only the most deliverable records.

2. That they run “square radii” where they create a circle and then make a square around that and sell you all the records within the square. The inaccuracy can be staggering and often causes bank clients to miss-assign the closest branch.

3. There is no guarantee saying these are “marketing” not “mailing” lists with even current-month data failing DPV by 38%.

4. That they provide the same contact name multiple times because a given individual (owner or president of a small firm) is flagged as the HR, IT, purchasing, etc. decision maker.

5. They miss-assign geographic selects (bank locations by address or lat/long) including locating a bank branch in the middle of Lake Michigan, using the center of the state since the system didn’t recognize the zip code.

6. They are unable to assign “closest-branch-and-distance” to multi-radii (overlapping radii) counts or orders. We provide this service free or at a nominal charge.

7. They can’t suppress a given address if there is more than one business at that address (office buildings). They gladly suppress the deli on the first floor instead of your client record, even if it is a giant, headquarters office with thousands of employees filling the balance of the building.

8. We’ll suggest buying in “parts” to avoid paying for unpopulated data elements across the entire list. As an example, there’s no need to purchase “headquarter” or “parent company” information on non-branches or non-subsidiaries.

9. Over 30% of the records are home-based or branches and far too many are miss-coded as single locations.

10. They offer no subsets of full zip codes and lat/long is often far too inaccurate for our banking clients.

11. The 2-week and monthly “Hot List” of new businesses includes those up to 25-months old. Many records have not been updated in 2-full years, and the “updates” are often nothing more than verification of existence. Data elements and contacts often go several years without being “updated”, yet we find the data is more accurate than is available from their few competitors.

12. We’ll save you quite a bit of money and by law do not charge sales tax where they must.

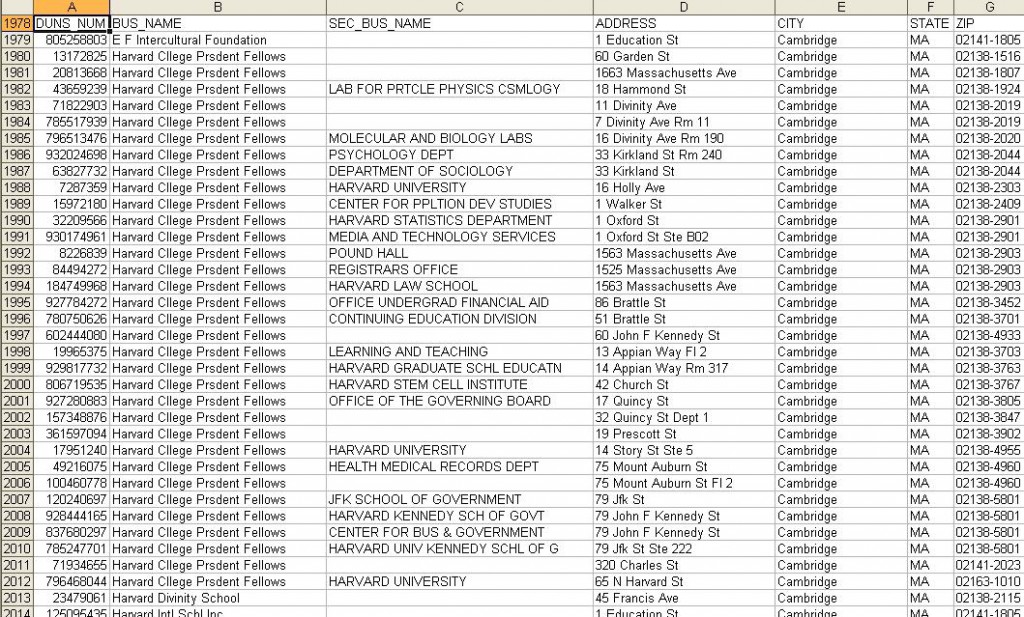

As with all lists, even the largest compiler has a great deal of inaccuracy and every possible select must be used to minimize erroneous records. In the example below they show 35-Harvard’s (and a poorly-abbreviated business name as well as many dups) and they have over 100 records for the headquarters of “Penn State” within their 27,000+-college headquarters records. Their education file has only 4,000, only 1 of which is Harvard and there’s one headquarters for Penn State.

They have even more Harvard headquarters records than are shown here as this list selected only the largest colleges in the nation, primary SIC only, Zip+4 only, DSF = 1 only, one per location, and headquarters and single locations only. The client expected only 1 Harvard and 1 Penn State. Well over 50% of the list is erroneous as every inappropriate record is pure junk-money thrown away.

D&B also has 5+ individuals listed as “President” at a given location. You’ll have no way of knowing which is the current or correct contact. Here it is often better to select “top contact”.

With your Epsilon choices:

1. We’ll help you properly select household status. One name per address or one per “household” is a 5%+ variable. One per household is the default (you and another adult without a matching last name constitute 2-households at the same address so you both get the mail piece).

2. We’ll help with your age selects to avoid the model “spikes”. You’ll also want to investigate the appropriateness of selecting “specific” versus “inferred” versus “all” as well as “self-reported” or “inferred” when using ages, incomes, child ages, lifestyle/interests, and other data elements.

3. We’ll assist you with household member targeted selections. Few are aware of the frequency and impact of the common yet highly significant mistakes made here.

4. We identify the most appropriate selects for net-worth, income producing assets, and home value selects. We’ll recommend you use length of residence when including renters and loan to value when using mortgage data. Probable homeowners are not homeowners. Credit data is modeled with a zip+4 component.

5. Half the counties in the nation have no court-house data so everything is modeled. Still, the Epsilon models are most conservative and we are certain, more accurate than is available from their few competitors.

6. We remind you to avoid the anomalies of the file (18-year old millionaires, etc.).

7. We’ll save you quite a bit of money and by law do not charge sales tax where they must.

We overcome many of the various file limitations, inaccuracies, mistakes, and more…

…by first running your counts and orders through programs to generate accurate geographic or demographic selects (Epsilon and others), which are then entered into other count systems. We then carefully select the most accurate contacts and other demographics. We’ll even run your orders through external de-duplication software before delivery (all at no charge).

We work with the most sophisticated banks, top 5 insurers, telemarketers, and even the nation’s largest market research firms.

These firms track results and choose us to provide them with current-month data and lists, relying on our expertise to provide data from the most appropriate sources using all of the appropriate selects.

How to buy a list, mailing lists, UCC lists, email lists, financial planners, list broker, Direct Response Associates, Inc. How to buy a mailing list How to buy a UCC list How to buy an email list How to buy a list of How to buy email How to buy email lists How to buy UCC lists List of Lists of How to buy a mailing list How to buy a mailing list of How to buy lists of How to buy a list of Dun & Bradstreet Dun & Bradstreet lists Dun & Bradstreet list of Mailing list Mailing list of UCC UCC data Email list of Email lists of